- Insider spoke to two bitcoin mining industry executives about the state of the industry after China's crackdown.

- The drop in bitcoin's hashrate as a result of the ban has made mining more profitable and easier than ever, Riot Blockchain CEO said.

- US mining companies are also facing a flood of demand from Chinese miners looking to house mining operations.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

China has taken a harsh view of the crypto space since the early days of bitcoin. Industry experts say though that June's outright ban on mining operations has been one of the most impactful moves by the country on the bitcoin network.

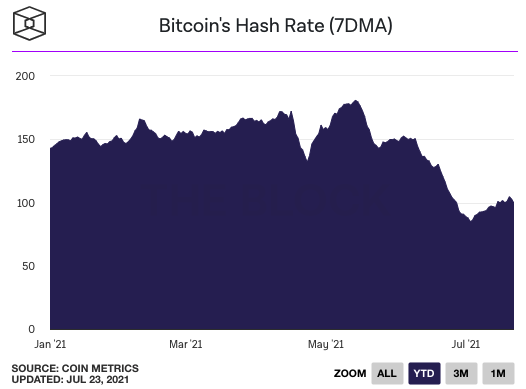

Look no further than the chart of the bitcoin hashrate, the measure of computing power being contributed to the network through mining, to see the ban's effect: a significant drop-off beginning in June as the authorities in the country implemented the ban.

The drop off isn't entirely negative for the mining industry, however. In fact, as more miners suddenly shut down in China, it made mining easier, and more profitable for those still able to operate.

"As miners, we're all competing against each other for the same fixed piece of pie, so when the competition drops off like that, you're just getting a bigger piece of the pie," said Jason Les, CEO of Riot Blockchain, one of the largest publicly traded mining companies.

He described to Insider how the network hashrate dropped 50% within a matter of weeks in June as mining in China stopped. Due to how bitcoin was designed, a drop in the hash rate also led to a drop in the network difficulty, meaning it was easier to mine with less people competing, and subsequently more profitable.

Les said the crackdown and drop in hashrate has created "tremendous" opportunities for miners unaffected by the ban, though he deeply sympathizes with miners in China, which is the birthplace of the bitcoin mining industry.

"I can't imagine going through something like that, where just suddenly you've devoted so much time and capital, you built this business, and then at the stroke of a pen, the government decides your business is done," he said.

As a result of the ban, miners in China are scrambling to relocate their operations to other countries. Les said his Linkedin inbox is flooded with inquiries from miners looking for facility space in the US.

"There have been Chinese miners who have just showed up in Texas asking 'can you take us to a mining facility that you know is nearby? We need capacity," he added.

The migration out of China is especially good for mining companies that are able to host third-party miners within their facilities, like Riot.

"Being a hoster puts us in a great position because now we have an increased base of prospective customers looking for space," said Les.

Interestingly, the mining ban in China has also helped bitcoin toward a fundamental goal of becoming a truly decentralized network, Whit Gibbs, CEO and co-founder of Compass Mining, told Insider.

Gibbs said the most "dangerous thing for Bitcoin" is for more than 50% of the hash rate to be located in any one country and vulnerable to the whims of one country's regulations.

For many years, many bitcoin enthusiasts were concerned about the hashrate being heavily concentrated in China. Now, miners are flocking to countries like the US, Kazakhstan, and Russia.

According to the Cambridge Centre for Alternative Finance (CCAF), the US's share of the total bitcoin hashrate increased from a mere 4.6% to 16.8% from September 2019 to April 2021.

"It makes for a more secure Bitcoin," Gibbs said.